Many UK drivers notice the same frustrating pattern: when oil prices rise, petrol and diesel prices at the pump go up quickly — but when oil prices fall, pump prices often seem slow to follow.

This isn’t just a feeling. Recent analysis from the Competition and Markets Authority (CMA) confirms that fuel prices in the UK do not always respond to changes in wholesale costs as quickly or as fully as drivers would expect.

So why does this happen?

Fuel prices don’t move in a straight line

The price you pay at the pump is influenced by several layers:

- Global oil prices

- Refining and distribution costs

- Fuel duty and VAT

- Retailer pricing decisions

While oil prices are an important factor, they are only one part of the final price. When wholesale fuel costs fall, retailers are not legally required to pass those savings on immediately — and in many cases, they don’t.

Weak competition keeps prices higher for longer

One of the key findings highlighted by regulators is that competition between fuel retailers remains weak in many parts of the UK.

In areas where drivers have limited choice — for example, rural locations or places dominated by a small number of brands — petrol stations face less pressure to reduce prices quickly. Without strong competition, retailers can maintain higher prices without losing significant numbers of customers.

This means that even when wholesale fuel costs drop, the benefit isn’t always passed on at the pump straight away.

Prices rise fast — but fall slowly

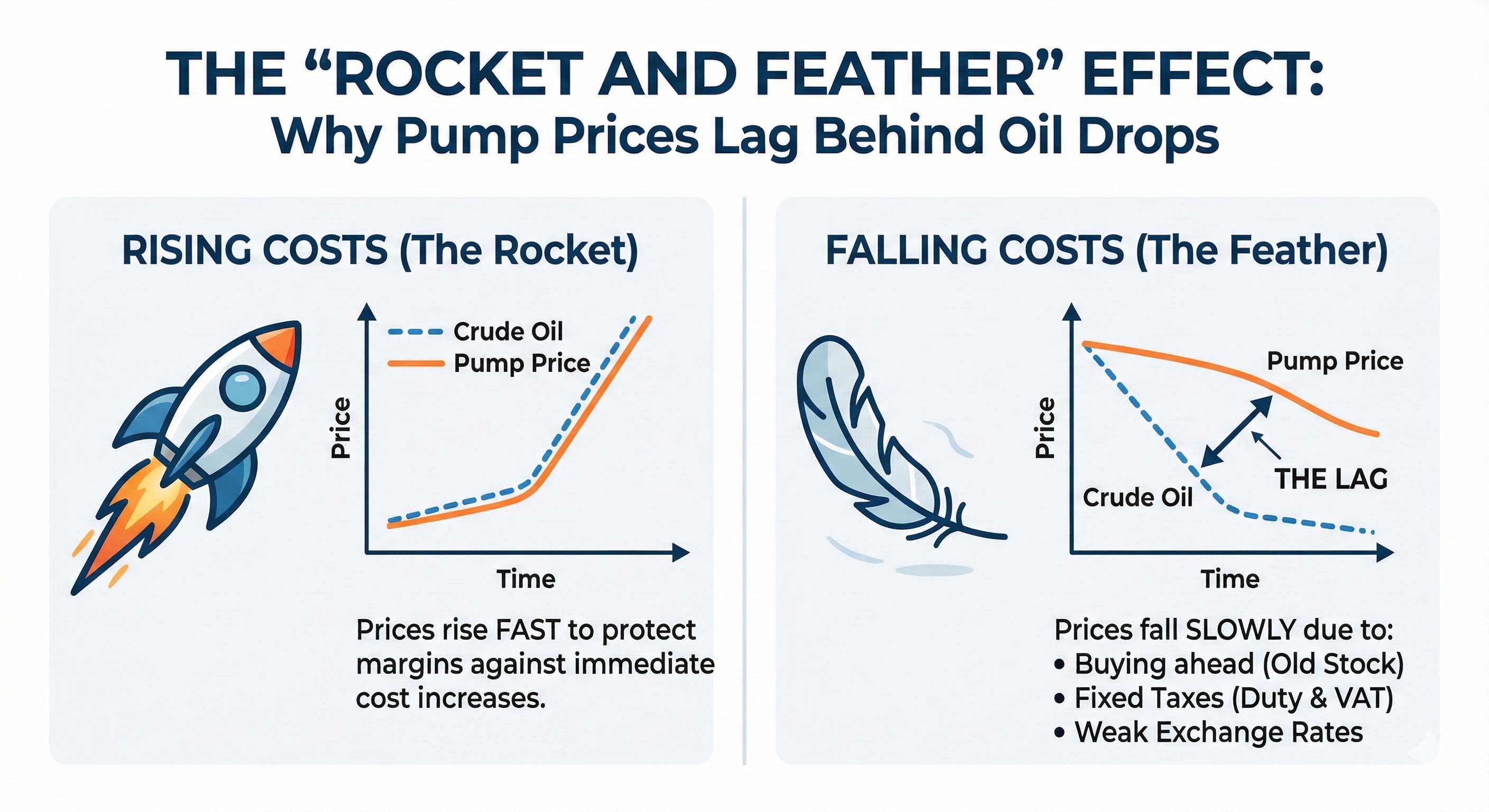

The "Rocket and Feather" Effect

Fuel pricing often follows what economists describe as a pattern where prices rise like a rocket when costs increase, but fall like a feather when costs decrease.

Retailers tend to respond rapidly to cost increases to protect their margins, but take longer to reduce prices when costs fall. Over time, this behaviour results in drivers paying more than expected compared with wholesale price movements.

Retail margins are still elevated

Retail margin is the difference between what a petrol station pays for fuel and what it charges drivers.

Recent monitoring shows that fuel margins remain higher than historic averages, particularly at non-supermarket petrol stations. While supermarkets usually offer lower prices, even their margins have stayed above long-term norms.

Importantly, regulators found no strong evidence that these higher margins are fully explained by increased operating costs such as wages, energy bills, or investment in EV charging infrastructure.

Operating costs don’t tell the full story

Fuel retailers often point to rising costs — including staffing, utilities, security, and infrastructure — as reasons for higher pump prices. While these costs do exist, official analysis suggests they do not fully account for why prices stay elevated when wholesale costs fall.

In other words, cost pressures alone do not explain the slow movement of pump prices.

What this means for UK drivers

The key takeaway for drivers is simple: prices can vary significantly between nearby petrol stations, even when wholesale costs are falling.

Because price reductions are not passed on evenly or immediately, shopping around remains one of the most effective ways to save money on fuel. Even small differences of a few pence per litre can add up to meaningful savings over the course of a year.

Why fuel price comparison matters more than ever

As long as competition remains uneven and price movements stay slow on the way down, drivers who rely on a single local petrol station are more likely to overpay.

Using fuel price comparison tools helps:

- Identify cheaper stations nearby

- Avoid consistently high-priced locations

- Make informed choices rather than relying on assumptions

With improved transparency and better access to price data expected in the coming years, drivers who compare prices regularly will be best placed to benefit.

The bottom line

UK fuel prices don’t always fall as quickly as oil prices because competition is weak, pricing behaviour favours slower reductions, and retailers are able to maintain higher margins for longer than many drivers expect. Until the market becomes more competitive and pricing becomes more responsive, checking fuel prices before filling up remains one of the simplest ways to keep costs down.